Together, let’s shape the future of Polish fintech!

Unleash the hidden potential of your portfolio with a strategic partership in Poland's thriving fintech sector, spearheaded by Comfino, a leading Warsaw-based company.

First Online and Offline payment gateway in Poland

Comfino is a pioneering, unique, and authorial one-step service embedded in multiple dimensions and available across various levels. It is the first platform to provide financing in both Online and Offline areas, with offers addressed to both individual and business customers.

With artificial intelligence, Comfino facilitates Online client assessment and connect each interested person with the appropriate payment method.

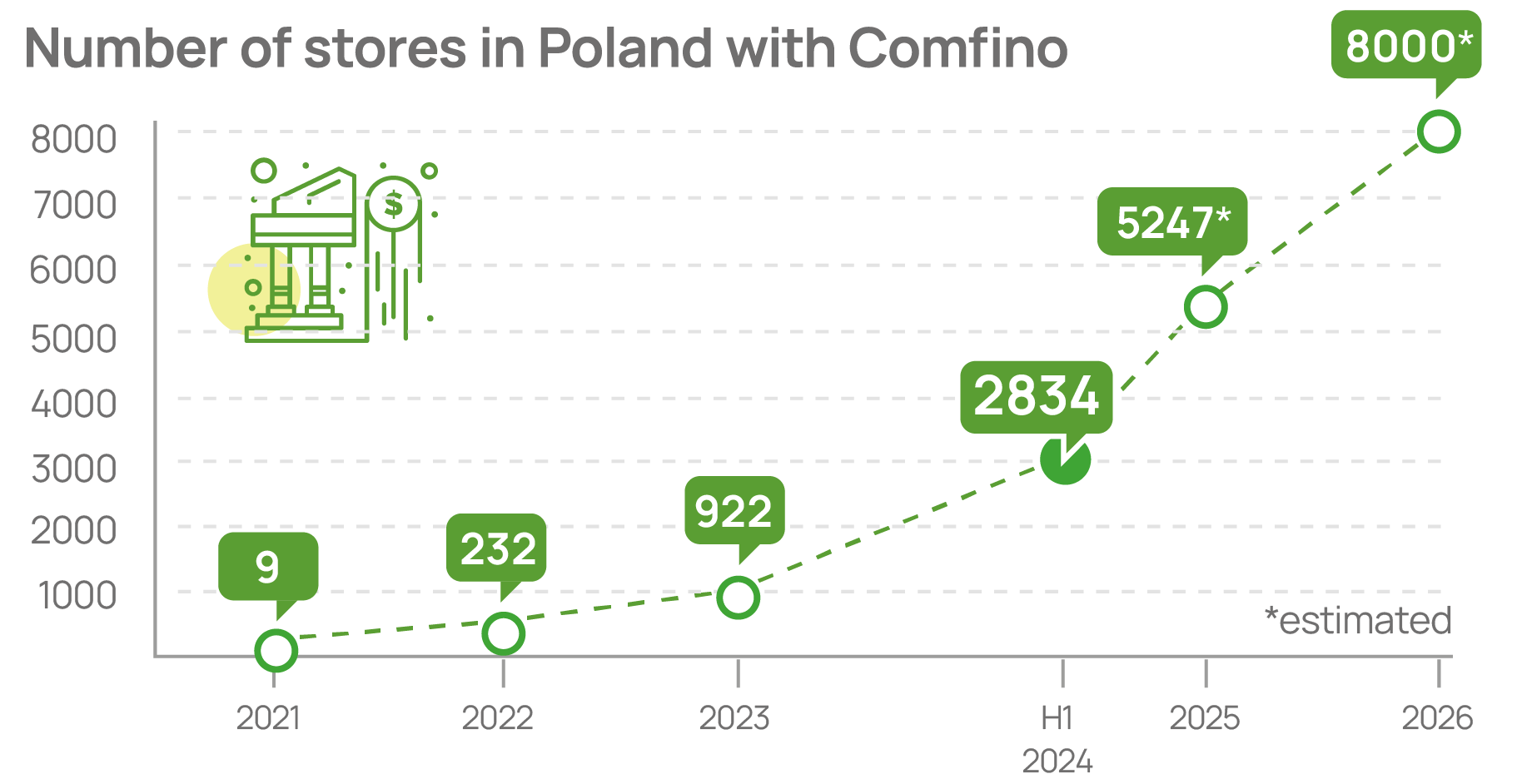

Comfino was created in 2021 to revolutionise e-commerce payments.

A well-known brand, endowed with consumer trust and holding an established position.

Comperia’s extensive experience in the fintech, e-commerce and IT solutions sectors.

Using experience in cooperation with the largest banks and financial institutions in Poland

How Comfino works?

Comfino process overview:

Client adds products to the shopping cart

Client chooses

payment method

Client enters his data

Comfino selects best offer

Client signs the contract online

Payment immediately sent to store

Client receives ordered goods

Comfino also has power through technology partnerships:

Comfino has successful track record in new client acquisition, targeting both online and offline channels, which is a crusial advantage and makes it the only such fintech in the market.

Financing providers:

SaaS Platforms (and their market share in PL):

We provide whole ecosystem of payments:

Revolutionary e-commerce payment solution — unique marketplace aggregating multiple BNPL payments in one place.

Simple e-commerce store integration through one plugin.

Free of charge implementation and subscription-free pricing model based on a scalable transaction fee.

Our advantages:

- Unique operating concept -> using AI to present the payment method.

- Rescue process - phone support for customers to fill out applications or find an alternative financing model.

- Coverage of both Online store service and brick-and-mortar outlets — omnichannel model.

- Providing continuity of financing. We adapt the bank’s offer to the customers. We are immune to bank failures and anomalies.

- In-house team of developers constantly working on the product, integrations and customisation for the largest customers.

- 17 sales managers in all categories and sizes of customers which ensures full market coverage.

- Number one solution for the medical market, which includes 20k establishments (private hospitals, dental clinics, beauty salons).

- Comfino continually explores new industries.

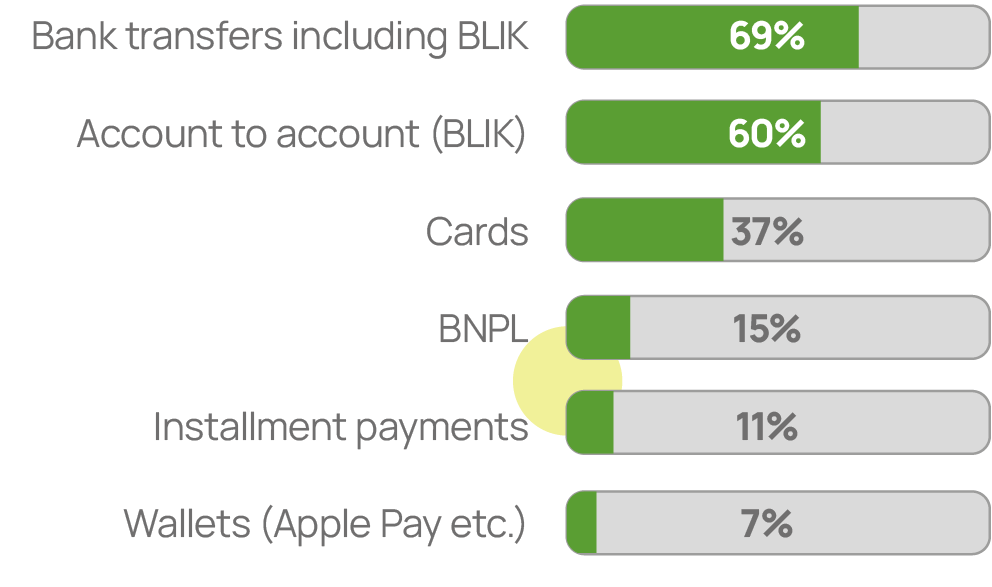

Variety of payment methods is crucial:

Payment methods ever used for ecommerce purchases:

Purchasing habits in Poland:

Six out of ten Poles decide to make a purchase when they find a convenient payment method!

BLIK It is currently used by six out of ten shoppers.

Almost half use fast electronic payments. Interestingly, the popularity of card payments (from 33 to 37 per cent), deferred payments

(from 8 to 12 per cent) and Apple Pay (from 4 to 7 per cent) has increased significantly over the past year.

E-commerce payments in the future will be shaped by new payment technologies available for customers.

BNPL (buy now, pay later) payments emerged in 2020 and are expected to further penetrate payments market, e.g. PayPo, one of the BNPL payments providers in Poland in last periods noted +57% y/y.

The popularity of these services is expected to increase rapidly, due to numerous advantages and current macroeconomics:

- 73% of largest e-commerce stores in Poland already implemented installment/BNPL.

- Installment and BNPL payments allow customer to minimize credit costs or deref it.

Both models allowing e-stores to:

- Increase average basket size;

- Increase revenue from online sales;

- Reach a group of new or less affluent customers;

- Higher sales conversion.

Our platform is a gateway to the whole EU.

2022 in numbers:

Gross Domenstic Product

(in $bn)

0

Population of EU

(in millions)

0

Internet users

(percentage of population)

0

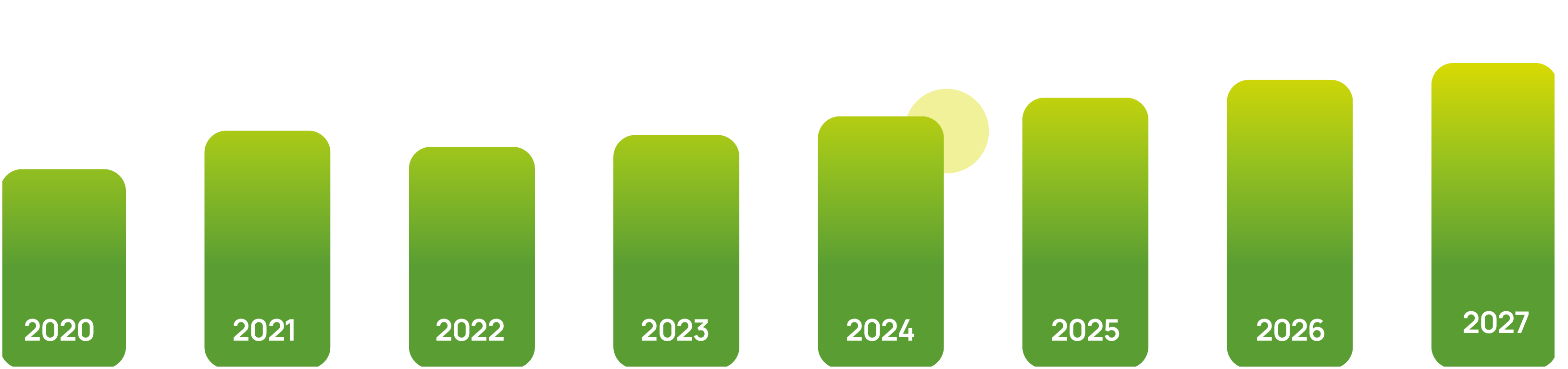

% Revenue development in the European e-commerce market 2020 - 2027:

In billion US$, Sources: ECDB